Our Expertise

Our goal is to become The trusted partner, making equipment finance easy, and the first point of reference for vendors, resellers, brokers and manufacturers in the UK, delivered through consistent customer focus, innovation and service excellence. We are proud to be part of BPCE Equipment Solutions’s global network, supporting international equipment manufacturers and distributors in 31 countries worldwide. We work in a range of industries, including Agriculture, Transportation, Industrial, Construction, High Technology and Medical.

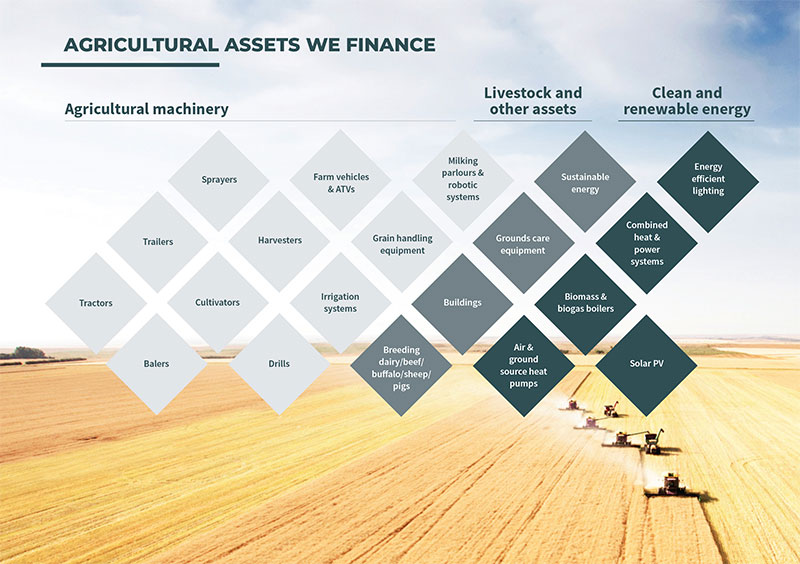

Agriculture

Who we are

BPCE Equipment Solutions is a global leader and an award-winning funder for the provision of vendor and equipment finance for businesses. Since entering the UK agricultural market in 2006, BPCE Equipment Solutions has established a proven history of providing high service levels of asset finance to all partners: manufacturers, dealers, brokers, as well as to our end-user customers. From agricultural machinery to livestock and buildings to renewable energy and new technologies, we provide a wide range of flexible financial solutions for agricultural investments.

Supporting growth

As part of our agricultural equipment finance offering, BPCE Equipment Solutions offers flexible financial solutions for any type of new or used asset that is used for business purposes within the agricultural environment. Our dedicated team are specialists in creating repayment solutions designed to reduce cash flow pressures. We can support you to obtain cash flow funding for all your agricultural purchases and will work with you to make the process as simple as possible.

We have a wide range of flexible finance products available within this market sector

Hire Purchase:

Ideal for business customers wanting to own the asset at the end of the finance period, such as agricultural equipment and machinery.

Finance Lease:

Best suited for business customers who do not want to own the asset but need to have the ‘use’ of it for a fixed period of time.

Operating Lease:

For business customers looking to have use of equipment, benefiting from a known fixed cost (may include service and maintenance) from a predicted annual use.

Sale and Lease Back:

A facility for business customers to convert a recent purchase into a financial agreement whilst releasing cash from the asset back into the business.

Private Sale:

Available for business use only, Private Sale covers the purchase of equipment from a farmer rather than an equipment supplier.

Available for business use only, Private Sale covers the purchase of equipment from a farmer rather than an equipment supplier.

Business Loan:

Suitable for business customers to raise funds for a non-asset investment such as building or farm maintenance and livestock.

For any enquiries, please contact:

agsupport-uk-es@groupebpce.com

or

James Dalke

Head of Agriculture

james.dalke@groupebpce.com

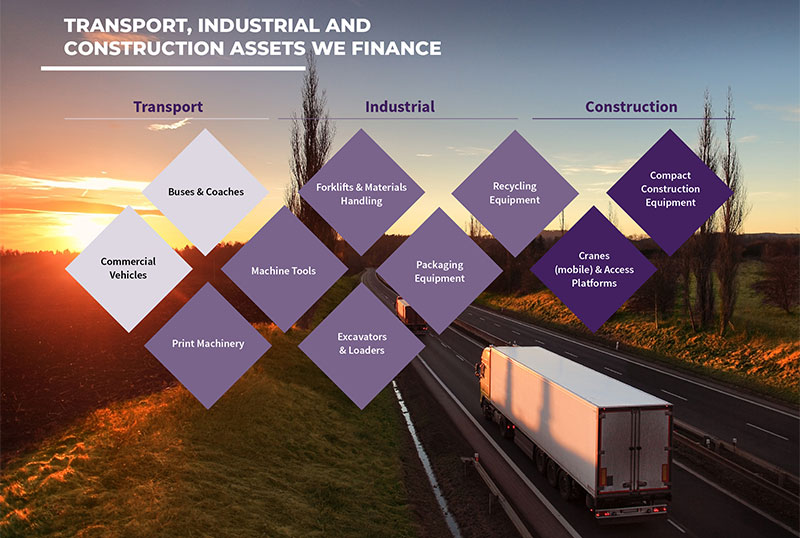

Transport, Industrial and Construction

Who we are

BPCE Equipment Solutions is a global leader and award-winning funder for the provision of vendor and equipment finance for business. Since the early 1990’s BPCE Equipment Solutions has established a proven history of delivering high service levels in equipment leasing to all our partners: manufacturers, dealers or brokers, as well as to our end-user customers. We have a dedicated team of industry-experienced individuals with specialist knowledge who understand the demands and needs of the industrial world. Our team can provide as much help and support as needed with any transport, industrial and construction leasing enquiries to offer your customers a financial solution that brings

added value and differentiates your equipment offering.

Supporting growth

As part of our transport, industrial and construction equipment finance offering, BPCE Equipment Solutions offers flexible financial solutions for any type of new or used asset that is used for business purposes within the transport, industrial and construction environments. Our dedicated team are specialists in creating repayment solutions designed to reduce cash flow pressures. We can support you to obtain cash flow funding for all your equipment purchases and will work with you to make the process as simple as possible.

We have a wide range of flexible finance products available within this market sector.

Contract Hire:

Best suited for businesses where the equipment needs to be managed and maintained within one lease contract. The asset cost along with a repair and maintenance contract can be combined into a single payment due at regular intervals. The future value of the equipment will be recognised, thus reducing payments.

Operating Lease:

Ideal for business customers looking to acquire equipment on a relatively short-term basis.

Hire purchase:

Ideal for business customers wanting to own the asset at the end of the finance period. VAT is payable in full up-front.

Finance lease:

Best suited for business customers not wanting to own the asset but needing to have the ‘use’ of it for a fixed period of time. VAT is payable on each rental payment.

Sale and Lease Back:

Available for businesses wanting to inject cash back into their business from recently bought assets.

Stocking Finance:

Allowing you to finance your new stock, demonstration equipment and any used equipment you take back as part of a trade-in.

Our financial solutions offer the payment structures and terms that best suit your customer’s business needs. We can tailor their finance to match the payment structure to their income.

For any enquiries, please contact:

Hannah Ward

Head of Transport, Industrial and Construction

hannah.ward@groupebpce.com

M: 07884 480 875

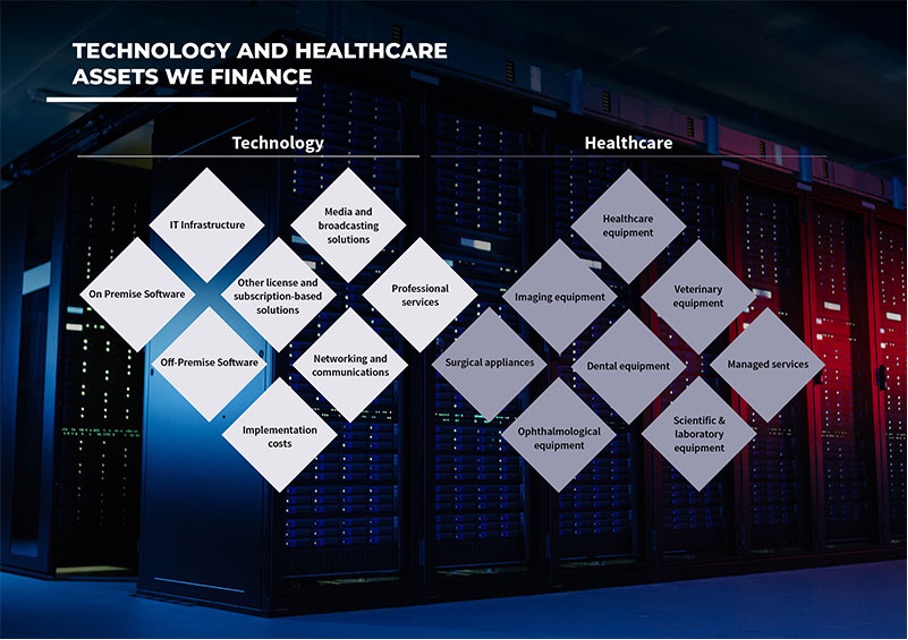

Technology

Who we are

BPCE Equipment Solutions is a global leader and an award-winning funder for the provision of vendor finance for businesses.

We have amassed broad and deep specialist industry knowledge and expertise in structuring financial solutions for IT infrastructure, software solutions and healthcare equipment, to meet a variety of private and public sector requirements.

Our portfolio and finance offerings

Our technology portfolio is mainly focused on providing funding for sales finance programmes with manufacturers, specialist distributors and service providers. Our finance offerings are especially suited for partners providing solutions in IT: data storage, PC’s, tablets, hardware, software, peripherals.

Experts in technology finance

With over 25 years’ continuous experience in the technology finance marketplace, we can offer a deep understanding of your sales processes, routes to market and what is required to make a finance programme effective and embedded in your business.

We have a number of international technology vendor partners with whom we have worked and supported for more than 20 years and our ability to support your customer finance programmes covers a range of transactional sizes, from small ticket programmes with individual deals sizes as small as £5k up to individual transactions of £20m+.

We can deliver solutions directly to your customers, re-finance your own branded offer and also provide non-recourse equipment finance solutions for your managed service contracts.

Supporting growth

We work to industry best practices in both the private and public sectors and our dedicated team of industry-experienced individuals with specialist knowledge understand the demands and needs of the technology and healthcare environments.

We have a wide range of flexible finance products available within this market sector

Finance Lease :

Ideal for businesses needing the use of technology for a period of time, but not wanting to own it.

Hire Purchase:

Suitable for businesses waning to own the equipment after a fixed period of time.

Funded service contracts:

Gives your customer the ability to embed regular financing payments in their service contracts. Adaptable to support SaaS, IaaS and other service, license or subscription based products.

Operating Lease:

Useful for businesses or state-funded schools, helping them to meet their educational funding requirements.

Software Lease:

Enables customers to finance software solutions over a fixed period.

Software Payment Plan (Loan):

Provides a simple payment plan for subscription and term licenses based software products.

All our financial solutions are flexible, offering your customers the payment structures and terms that best suit their financial needs, including alignment with cost savings and tailored repayment profiles if required.

For any enquiries, please contact:

HTV-Sales-uk-es@groupebpce.com

or

Vincenzo Scalzone

Head of Vendor Programmes

Technology & Structured Finance

vincenzo.scalzone@groupebpce.com

+44 (0)7771 333768

Healthcare

Who we are

BPCE Equipment Solutions is a global leader and an award-winning funder for the provision of equipment finance for businesses within the healthcare sector. For 35 years, we have amassed broad and deep specialist industry knowledge and expertise in structuring financial solutions for healthcare equipment, as well as a proven history of delivering high service levels in equipment leasing to all our partners, as well as to our end-user customers.

We work closely with a variety of leading medical equipment vendors and specialist finance providers.

Our vendor partners use financing packages to boost the sale of medical equipment, strengthen their clients’ loyalty and manage second hand equipment values.

Our clients include doctors, dental and veterinary practices, opticians, public and private hospitals, laboratories (including dental labs), research institutes and universities and the types of medical equipment we typically fund include clinical IT solutions; ultrasound equipment; MRI and CT scanners; dental equipment; microscopes; ophthalmological equipment; endoscopy equipment; lasers and X-ray equipment.

Transaction size can range from £5k to £5m+. Depending upon the equipment type and term we are able to take residual value positions in equipment to deliver operating lease solutions.

Supporting growth

We work to industry best practices in both the private and public sectors and our dedicated team of industry-experienced individuals with specialist knowledge understand the demands and needs of the technology and healthcare environments.

We have a wide range of flexible finance products available within this market sector

Finance Lease:

Ideal for businesses needing the use of technology for a period of time, but not wanting to own it.

Hire Purchase:

Suitable for businesses wanting to own the equipment after a fixed period of time.

Funded service contracts:

Gives your customer the ability to embed regular financing payments in their service contracts. Adaptable to support SaaS, IaaS and other service, license or subscription based products.

Operating Lease:

Useful for businesses or state-funded schools, helping them to meet their educational funding requirements.

Software Lease:

Enables customers to finance software solutions over a fixed period.

Software Payment Plan (Loan):

Provides a simple payment plan for subscription and term license based software products.

All our financial solutions are flexible, offering your customers the payment structures and terms that best suit their financial needs, including alignment with cost savings and tailored repayment profiles if required.

For any enquiries, please contact:

HTV-Sales-uk-es@groupebpce.com

or

Alison Hawke-Jolly

Head of Broker and Flow Channel

Technology and Medical

alison.hawke-jolly@groupebpce.com

+44 (0)7384 872175

Green Energy

BPCE Equipment Solutions works closely with a number of vendors, brokers and partners to deliver flexible financial solutions in the Clean and Renewable Energy sector.

Our goal is to support businesses of any size to become more sustainable and to help them to achieve more positive and cleaner working practises. We provide financing to help procure new – less energy intense – equipment, thereby enabling our customers’ energy transition process. We also use residual value finance products to encourage the reuse of the equipment once it comes back to us, to allow for the recycling of products.

Funding structures available range from regular payment profiles to more complex cash flow structured repayments and products offered include:

Hire Purchase | Finance Lease | Business Loans |Operating Lease | Receivables Finance

Renewable and clean assets we finance:

Wind Turbines | Solar Panels | Battery Storage | Bio-Mass Boilers | Heat Pumps | LED Lighting | Micro Anaerobic Digesters | EV charge Points | Electric vehicles

As the marketplace evolves, we will look to finance the latest assets to help your business to transition for a more sustainable future. Get in touch and see how we can help.

To find out more about BPCE Equipment Solutions Group’s commitment to sustainability, please click here.

To find out more about our sustainability approach, please click here.

Check out our latest video below, which addresses why BPCE Equipment Solutions is a key partner in helping your business to generate a positive impact, to deliver sustainable long-term growth.

Contact Details

Vincenzo Scalzone

Head of Vendor Programmes

Technology & Structured Finance

vincenzo.scalzone@groupebpce.com

+44 (0)7771 333768

Asset Management

Our experienced Asset Management team have expertise across a variety of assets, sectors and industries and can provide bespoke residual values that reflect your asset choice, business and usage, on an individual or programme level.

The team monitor assets across the portfolio and provide End of Term solutions that best fit your requirements, whether you are a lessee, vendor partner, manufacturer or lease introducer.

We can work with you to manage equipment return for assets that have reached the end of lease and are returning to us, prior to the sale of the asset to realise market value. Working with our approved and experienced network of industry specialists, we ensure a fair and transparent return process.

This service is provided across all our core business areas of Transport, Industrial & Construction, Healthcare, Technology, Agriculture and Green Energy, as well as the Public Sector market.

In addition to providing residual values we are also able to acquire and/or manage existing residual value portfolios for vendors and third parties.

Contact Details

William Moses

Head of Asset Management

william.moses@groupebpce.com

07443 370401

Public Sector

We have been active in the UK Public Sector market since 1991.

We can provide Operating and Finance Leases to Local Authorities on a wide range of assets including:

- Computer hardware and software

- Telecommunications & office equipment

- Copiers and printers

- Fire appliance vehicles and equipment

- Commercial vehicles (HGVs & LCVs), gritters, sweepers, refuse vehicles, groundscare, cars, Fire Authority vehicles, welfare buses, yellow plant, and specialist vehicles

- Gym equipment

In addition, we can also offer Operating and Finance Leases to NHS Trusts for a variety of assets, such as:

- Medical and laboratory equipment

- MRI, CT and Ultrasound scanners

- Dental equipment

- Ophthalmological equipment

- Microscopes, endoscopy equipment

- Lasers and X-ray equipment

- Patient Transfer and Rapid Response vehicles

- Bariatric vehicles

- A&E ambulances

- Groundscare and commercial vehicles

We have provided a range of financing solutions to over 200 Local Authorities and over 40 NHS Trusts.

Public Sector Financing products available are:

- Finance Lease

- Operating Lease

Contact Details

Hannah Ward

Head of Transport, Industrial and Construction

hannah.ward@groupebpce.com

M: 07884 480 875

Contact us

Votre demande de contact a bien été enregistrée.

Revenir à l’accueilUne erreur s’est produite pendant l’envoi du message.

Nous vous invitons à réessayer.

Réessayer Revenir à l’accueilFor more information

-

Customers & Partners

Découvrir maintenant

-

Careers

Découvrir maintenant

-

Products & Services

Découvrir maintenant